- AI, Sage Intacct

Artificial intelligence (AI) is transforming how businesses operate across nearly every industry. From healthcare to hospitality, and especially in the world of finance, AI is significantly improving efficiency, accuracy, and strategic insight. For businesses in the UK who want to stay ahead of the competition, one of the fastest ways to transform operations is to use the latest AI-powered software solutions.

In this blog, we explore how AI is evolving within the accounting world; from early automation to intelligent systems, and how modern solutions like Sage Intacct are helping businesses work smarter and achieve long-term growth.

AI’s growing role across every sector

It’s impossible to ignore the impact AI is having across the business landscape. Retailers use AI to optimise inventory management and anticipate customer needs. Manufacturers use it to track supply chains and simplify complex workflows. When it comes to finance departments, AI goes even further, helping teams automate time-consuming tasks, improve data accuracy, and generate real-time insights that drive profit.

Modern financial management systems now come with powerful AI tools built in. For accounting teams, AI is reshaping daily operations, allowing them to work more efficiently and dedicate more time to strategic growth. With AI embedded, accounting systems are evolving into powerful tools that drive insight, efficiency, and sustainable growth.

The evolution of AI for accountants

AI has come a long way in a relatively short period of time. It has evolved from a carefully scripted tool that requires supervision and is now capable of completing tasks independently, ensuring safety and accuracy, and only needing human intervention if there is an issue. Today’s AI comes in three main forms:

1. Task-Based AI

Early AI automated repetitive tasks like reading invoices, categorising transactions, and flagging anomalies, reducing manual work but requiring close supervision.

2. Generative AI

More interactive and adaptable, generative AI helps accountants analyse trends, run forecasts, and draft reports, enabling collaboration between humans and AI.

3. Agentic AI

The newest AI works autonomously within accounting systems, executing processes end-to-end and only requesting human input when necessary, significantly boosting productivity.

AI-powered accounting: How Sage Intacct transforms tasks

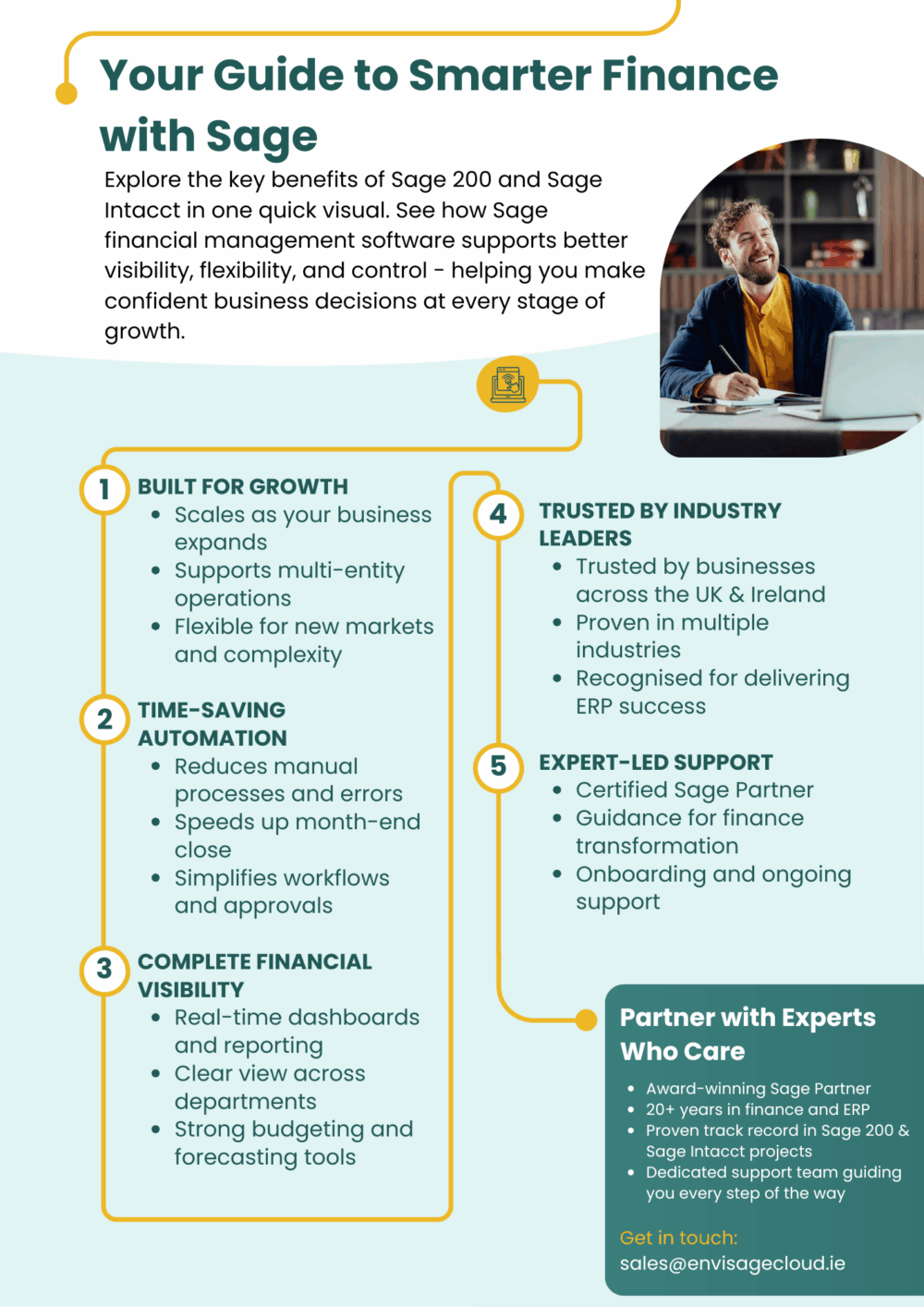

Sage is leading the way for UK businesses looking to harness AI in accounting. Sage Intacct comes equipped with built-in AI capabilities designed to simplify tasks, provide predictive insights, and support data-driven decision-making. For accounting teams, AI can transform operations in practical ways:

• Simplifying invoice processing

• Detecting unusual transactions

• Automating the month-end close

• Chasing unpaid invoices

• Submitting VAT returns

• Maintaining compliance

Sage Copilot: AI assistant for insight and efficiency

One of the most powerful innovations within Sage Intacct is Sage Copilot, an advanced generative AI assistant designed to work alongside accounting teams. Built on over four decades of expertise, Sage Copilot helps businesses achieve greater efficiency, insight, and operational confidence:

• Automating routine tasks – drafting payment reminders and handling other repetitive work, so teams can focus on strategic activities

• Providing actionable insights – real-time analysis of performance metrics highlights opportunities, trends, and areas for improvement

• Ensuring accuracy and compliance – continuous checks for anomalies and regulatory risks give peace of mind without slowing processes

Beyond Copilot, Sage Intacct’s AI-powered platform delivers significant benefits for UK businesses:

• Faster, smarter operations – automation accelerates daily processes, reducing manual bookkeeping and allowing teams to focus on decision-making

• Greater accuracy and confidence – AI-powered validation prevents costly mistakes and keeps books audit-ready

• Scalable growth – multi-entity, multi-location, and multi-currency support makes expanding operations seamless

• Flexible collaboration – cloud-based tools enable secure teamwork from anywhere, supporting remote and international teams

• Integrated ecosystem – seamless connections with industry-specific applications create a unified system, ensuring consistent, reliable data

Together, these features make Sage Intacct not just an accounting system, but a strategic enabler that empowers businesses to operate more efficiently, make smarter decisions, and adapt confidently as they grow.

Implementing Sage accounting software in the UK

AI is transforming accounting, helping businesses operate with greater speed, intelligence, and resilience. If you’re looking for the best accounting software in the UK to help optimise business processes, strengthen long-term growth, and transform the way you work, embracing Sage AI can be incredibly beneficial. Sign up to watch Sage Intacct in action and see how you can gain deeper insights, greater financial visibility, and improved performance across your entire organisation.

As a recognised Sage partner in the UK and Ireland, we make it easy for you to upgrade your financial management software to a comprehensive solution that benefits your business long-term. Our expert team supports a wide range of industries, providing tailored advice, implementation, training, and ongoing support to help you get the most from your system.

About the Author

David Burke

David Burke, the Technical Director for Envisage, is responsible for developing bespoke and off-the-shelf solutions, including easyDD for Sage. In 2023, he achieved accreditation as a Sage Intacct Implementation Certified Consultant.